Sales Tax Example: Child Jurisdiction Overrides Tax of Parent Jurisdiction

In this example, Pennsylvania state charges a sales tax rate of 6% for taxable goods and services. Philadelphia county, which is located in Pennsylvania state, charges an additional 1% tax on the same set of goods and services.

Important Note

This topic uses sample Sales Tax Rate records for Pennsylvania state and Philadelphia county to illustrate the sales tax functionality provided by Aptify and to illustrate how changing one or more fields can modify the sales tax behavior. These examples are not intended to reflect the actual requirements for these tax jurisdictions. Refer to Pennsylvania state's Web site (http://www.state.pa.us/) for information on its sales tax policies.

For reporting purposes, all tax proceeds are paid to Pennsylvania state so the 6% tax for Pennsylvania state does not need to be reported separately from the 1% tax for Philadelphia county.

This example contains the following scenarios:

- Tax Jurisdictions and Sales Tax Rate Records

- Sample Order - Pennsylvania Ship To

- Sample Order - Philadelphia Ship To

Tax Jurisdictions and Sales Tax Rate Records

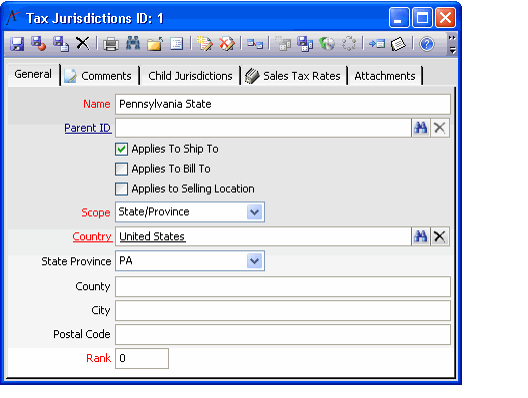

In this scenario, Pennsylvania state has the following Tax Jurisdictions record:

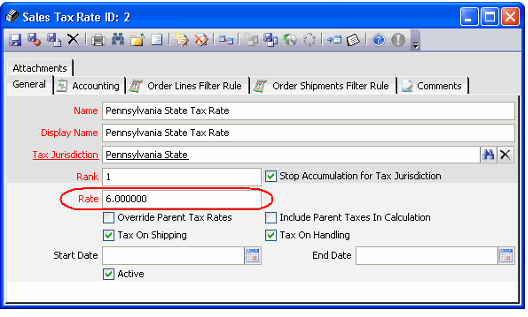

Pennsylvania state has the following Sales Tax Rate record for 6%:

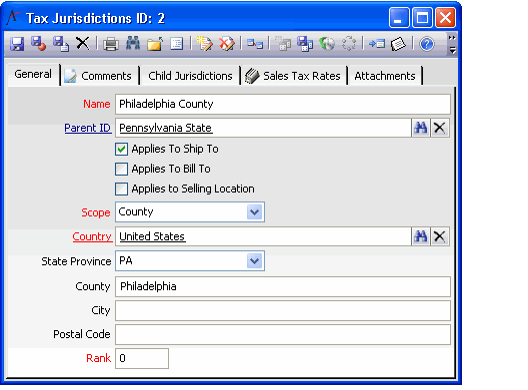

Philadelphia county has the following Tax Jurisdictions record (note that it is a child of the Pennsylvania state jurisdiction):

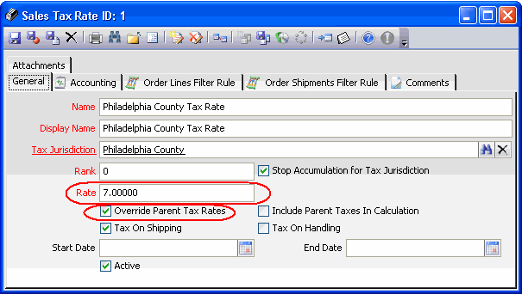

Philadelphia county has the following Sales Tax Rate record:

Note that since the Override Parent Tax Rates option is selected, the parent jurisdiction's tax rate will not be included in tax calculations for applicable order lines.

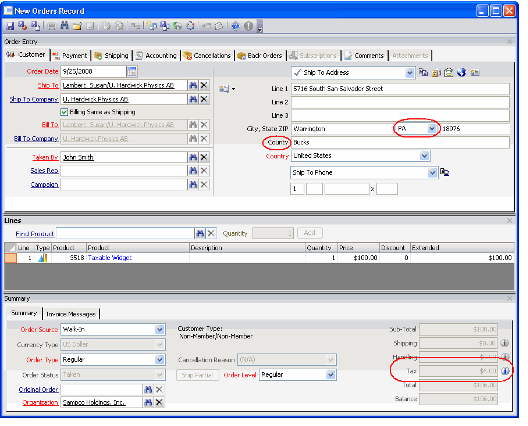

Sample Order – Pennsylvania Ship To

When a customer in Pennsylvania places an order for a taxable product, Aptify automatically calculates a 6% sales tax for the order, as illustrated in the figure below.

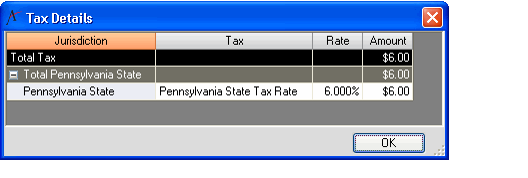

To view more information about the tax calculation, click the Information button to the right of the Tax field in the Summary area. The system displays the Tax Details window, shown in the figure below.

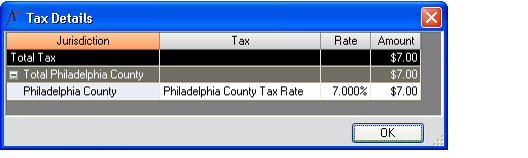

Sample Order – Philadelphia Ship To

When a customer in Philadelphia places an order for a taxable product, Aptify automatically calculates a 7% sales tax for the order. This rate overrides the 6% rate for Pennsylvania state. The following figure illustrates the Tax Details for a $100 taxable order whose Ship To is in Philadelphia.

Copyright © 2014-2019 Aptify - Confidential and Proprietary