Sales Tax Example: Tax Included in Price

For this example, assume that Pennsylvania state has mandated that the displayed price for all food products must include the applicable sales tax amount. Therefore, whatever price is charged the customer must include the 1% sales tax rate.

Important Note

This topic uses sample Sales Tax Rate records for Pennsylvania state and Philadelphia county to illustrate the sales tax functionality provided by Aptify and to illustrate how changing one or more fields can modify the sales tax behavior. These examples are not intended to reflect the actual requirements for these tax jurisdictions. Refer to Pennsylvania state's Web site (http://www.state.pa.us/) for information on its sales tax policies.

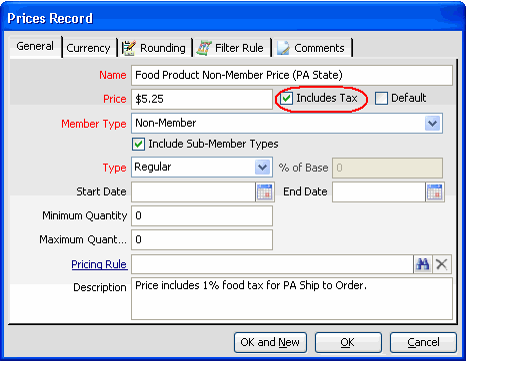

In this case, the organization selects the Includes Tax option on the Prices records for food products. In the figure below, the organization charges a non-member price of $5.25 per unit of the Food Product, and this amount already includes the 1% sales tax for Pennsylvania state. (Additional Filter Rules on the Prices record restrict this price to only customers in Pennsylvania.)

Then, when a customer in Pennsylvania places an order for a Food product, the system automatically extracts the appropriate tax amount from the product price.

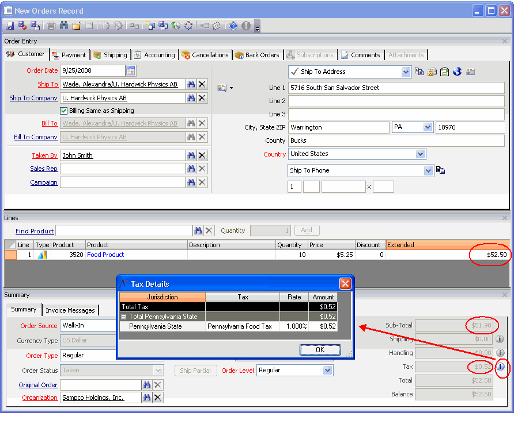

In the figure below, the customer orders 10 units of Food Product at $5.25/unit. This corresponds to an extended price of $52.50 for the order line.

Aptify automatically associates the order line with the applicable 1% sales tax and extracts that amount from the extended price. The system adds the tax amount to the Tax field and the remaining order line total (minus the tax) is added to the Sub-Total field.

In the figure below, the system computed the tax amount to be $0.52. This tax amount was added to the Tax field, and the remaining order line amount ($51.98) was added to the Sub-Total field.

Mathematically, $52.50 divided by 1.01 (1 plus the tax rate) equals $51.98 (rounding to the nearest cent). Subtracting this amount from the original total yields the applicable tax amount ($0.52).

Note Concerning Price Includes Tax Calculation

The example in this section illustrates the Price Includes Tax functionality for an order line that has a single tax rate applied.

When using the Price Includes Tax option in conjunction with an order line that has both a child sales tax rate and a parent sales tax rate applied (that is, the child rate has the Override Parent Tax Rates option cleared), Aptify calculates the tax amount under the assumption that the child tax includes the parent tax amount in its calculation.

This hold true even if a child Sales Tax Rate has the Include Parent Taxes In Calculation option cleared.

Copyright © 2014-2019 Aptify - Confidential and Proprietary