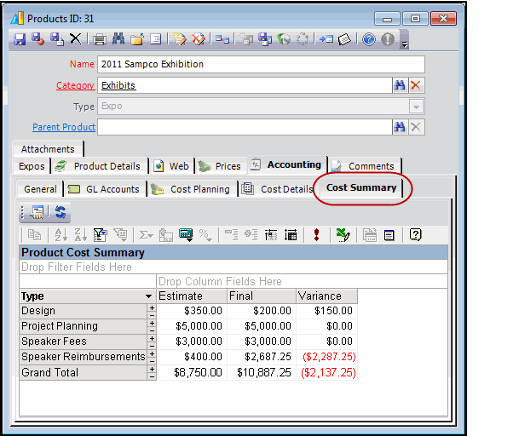

In Aptify, each Products record includes several cost related tabs that lets an organization track the various expenses incurred with getting a product to market. This includes a Cost Planning tab that can be used for planning the overall forecast of a given cost, a Cost Details tab that stores the details of each cost and a Cost Summary tab that displays useful summary statistics for a given product's expenses. These tabs are found under the Products record's Accounting tab. The following figure is an example of the Cost Summary tab that displays summary information about the expenses for a product by cost type.

For product cost tracking, Aptify also provides the ability to transfer the cost data from Aptify to an Accounts Payable (AP) system. Then, after the accounting department processes the product cost information within the AP system and prints the checks, a user can import the applicable check numbers back into Aptify. See the AP Integration chapter of the Aptify 5.5 Accounting and Financial Systems Integration Guide for more details.

Note that this information should not be confused with Unit Cost, which is tracked within Product Inventory Ledger Entries. See Managing Inventory for Products for more information on tracking inventory and unit cost.

This section covers the following topics related to tracking product costs within Aptify:

<add child display macro>

Creating Product Cost Types

Product Cost Types records store information about cost types for an event, publication or other products that accrue expenses. By default, Aptify includes Product Cost Types records for Design, Product Planning, Content Development, Tooling and Other. A member of accounting can create additional cost types using the following steps.

- Open a new Product Cost Types record.

- Enter the Name of the cost type.

- Enter a Description for the cost type.

- If the product cost type is a child of an existing Product Cost Types record, enter the name of the parent in the Parent field.

- Enter the name of the organization in which the cost type is associated in the Organization ID field.

- If you are planning on using the approval process for cost details, an organization is required to create the appropriate scheduled transactions.

- This setting has an impact for systems that have multiple functional currencies (assigned on a per-organization basis) as it will associate a product with a particular functional currency when creating schedule transactions for approved product cost detail records.

- Enter the name of the expense account associated with the cost type from the Expense GL Account drop-down list.

- Note that you must specify a expense account if you are planning to transfer cost data to an external accounts payable (AP) system.

- Enter the name of the liability account associated with the cost type from the Liability GL Account drop-down list.

- Note that you must specify a expense account if you are planning to transfer cost data to an external AP system.

Product Cost Types

- Save and Close the record.

Creating Cost Planning Records for Products

Cost Planning records store information about the overall cost associated with a product. Follow the steps below to create Cost Planning records for a particular product.

- Open the Products record.

- Click the Accounting > Costs tab.

- Click the New icon in the toolbar to open a new Costs sub-type record.

- Enter the cost type in the Type field.

- This field links to the Product Cost Types service. See About the Product Cost Types Form for more information.

- Enter the forecasted cost amount in the Forecast field. Specify the currency of the amount in the Currency Type field.

Costs Record

- Click the Comments tab and enter additional information about this cost estimate.

- Click OK to save and close the record.

- Add additional Costs records, as needed.

- Alternatively, you can click OK and New in Step 6 to save the current record and open a new Costs record in one step.

- Save the Products record.

If you are using Aptify to track cost details, when the final cost of the item is known (when at least one Product Costs Details record is created for a particular cost type with a finalized amount specified), the Calculated Actual column found in the view on a Product's Accounting - > Cost Planning tab is automatically updated with the sum of the each product cost for the particular cost type as shown in the figure below. The Actual field is not automatically populated.

If you are not using Aptify to track cost details, at a later date, when the final cost of the item is known, return to the product's Accounting > Cost Planning tab, open the appropriate Costs record and enter the final cost in the Actual field. The Calculated Actual column will not be populated in this case.

Cost Planning Tab - Calculated Actual Column

Creating Product Cost Details

In Aptify, each Products records includes a Cost Details tab that lets an organization track the various expenses incurred with getting a product to market. Follow the steps below to create Product Costs Details records that can be used to track expenses for a product:

- Open the Products records of the product you want to track costs.

- Alternatively, you can create Product Cost Types records directly from the Product Cost Types service.

- Select to the Accounting -> Cost Details tab.

- Open a new Product Costs Details record.

- You can also create Cost Planning records to forecast product costs. See Creating Cost Planning Record for Products for details.

- Enter a brief description of the cost in the Summary field.

- If the cost is a child of an existing Product Cost Details record, enter the name of the parent in the Parent field.

- Enter the name of the product associated with the cost in the Product field.

- This field links to the Products service.

- If the cost details record is opened from a Product's Accounting -> Cost Details tab, this field is automatically populated with the product's name.

- Enter the cost type in the Product Cost Type field.

- This field links to the Product Cost Types service. See Creating Product Cost Types for more information.

- Enter the name of the vendor associated with the cost in the Vendor field.

- This field links to the Companies service.

- Enter the name of the vendor contact in the Vendor Contact field.

- This field links to the Persons service.

- Enter the date in which the cost is to be delivered and paid in the Date Estimated field.

- Enter the estimated amount of the cost in the Amount Estimated field.

- If a finalized amount has been determined, enter the dollar amount in the Final Amount field.

- If a finalized amount has been entered, enter the date received in the Date Finalized field.

- Note that if a date is not specified when a cost is approved, today's date is populated in the Date Finalized field.

Product Cost Details - General Tab

- Enter the Status of the product cost. Options are as follows:

- Pending: Selected by default. The product cost is pending approval.

- In Review: The product cost is being reviewed by accounting or a qualified product manager.

- Approved: The product cost has been approved. A Scheduled Transactions record is automatically created for the expense accrued.

- You can view the associated Scheduled Transactions record by selecting the Scheduled Transaction link on the AP Integration tab as shown in the figure below.

- Note that when a Product Cost Details record is saved as approved, the fields on the General tab and the Original Product Cost Detail and Scheduled Transaction fields on the AP Integration tab become disabled for financial integrity purposes.

Product Cost Details - AP Integration Tab

- If this product cost is an adjustment of another product cost, you can enter the original product cost details record in the Original Product Cost Detail field on the AP Integration tab.

- Note that this field is for tracking purposes only.

- Save and close the Product Cost Details record.