About the Credit Card Payment Type

Aptify provides default payment types for four common credit cards: Visa, Mastercard, American Express, and Discover. An organization can add additional credit card payment types as necessary. (See Managing Payment Types for details.)

Aptify integrates with third-party credit card processors, such as PayPal, to provide realtime authentication of credit card numbers. When Aptify is integrated with a third-party processor, Aptify automatically communicates with the processor at the time a payment is saved. The processor then authorizes or denies the transaction. If authorizes, the payment is successfully saved; if denied, the payment is not saved.

After the payment's corresponding order has been shipped, a user runs the ePayment Capture wizard, which interacts with the processor to capture the payment and move funds to the organization's designed bank account. See Integrating with ePayment Providers for information on enabling integration with a third-party credit card processor and the payment capture process.

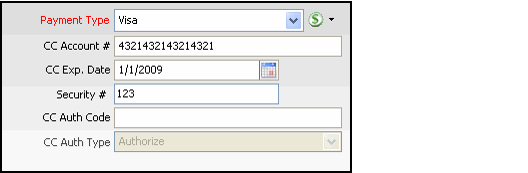

When you select one of the credit card payment types, the payment information area displays the following fields:

- CC Account # (required): The credit card's account number. This is required to save the payment. When working with a third-party credit card processor, the processor checks the validity of the card number and related information. If invalid, the payment does not save.

- Note that credit card numbers are encrypted in Aptify by default. Therefore, you must have access to the appropriate Security Key in order to save a credit card payment. If you do not have access to the key, an error message appears stating that the credit card number field cannot be blank. See Granting Access for Credit Card Number Encryption or contact your administrator for assistance.

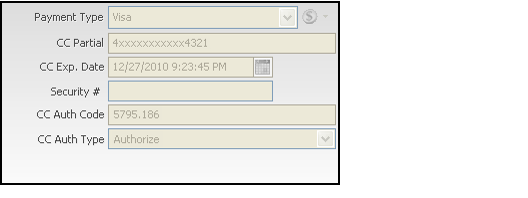

- After save, Aptify replaces the full credit card account number with the partial credit card number (which is the first digit, followed by a series of asterisks, and then the last four digits of the account number).

- CC Exp. Date (required): The credit card's expiration date. When working with a third-party credit card processor, the processor checks the card's expiration date. If invalid, the payment does not save.

- Security #: This is the three- or four-digit number that appears on credit cards in addition to the account number. It is also known as the Card Verification Value code (CVV) or as the Card Security Code (CSC). Depending on your organization's business rules, you may need to enter the security number as part of the credit card authorization process.

- Note that based on industry requirements, an organization should not store a credit card's security number in a database. Therefore, if you specify a security number, it is transmitted to the third-party processor but it is not saved to the database. Therefore, the system blanks out the field after the payment has been successfully saved.

- CC Auth Code: When entering a new credit card payment, leave this field blank. Aptify automatically inserts the authorization code received from the third-party processor into this field when the payment is successfully authorized. (This assumes that your organization has configured integration with a third party processor.) Note that if you have manually received an authorization code (such as a voice authorization code over the telephone), you can enter that code here before saving the record.

- CC Auth Type: This is read-only field. Upon initial save, the credit card authorization type is set to Authorize. After a credit card payment has been captured using the ePayment Capture wizard, the system automatically updates the Auth Type to Capture.

When creating a credit card payment, complete the CC Account #, CC Exp. Date, and Security # (if required by your organization's business rules).

Copyright © 2014-2019 Aptify - Confidential and Proprietary