Including Tax within a Product's Price

Certain jurisdictions may require that sales tax amounts be included in a product's price. In this case, Aptify can calculate the taxable portion of a product's price and display the applicable tax amount on the order. This section describes how to indicate that a product's price includes tax. See Sales Tax Example: Tax Included in Price for an example of how the system calculates tax when it is included in the product price.

- Open a new or existing Products record.

- For new products, configure the product as described in Marking a Product As Taxable. Note that you must identify a product as taxable prior to saving the record for the first time.

- For existing products, click the Accounting tab and confirm that the Taxable option is selected. Including tax within a product's price is not applicable for nontaxable products.

- Click the Prices tab and open a new Prices record.

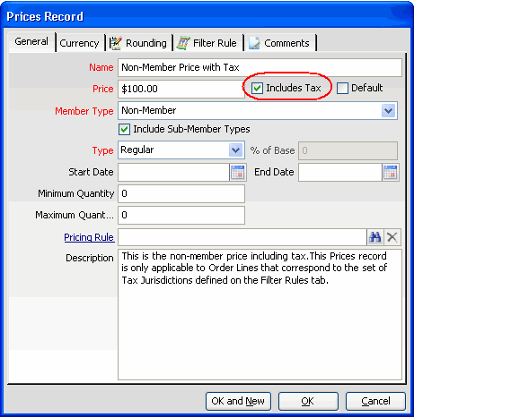

- Enter a Name for the Prices record.

- Enter the Price to charge on the order line.

- Select the Includes Tax option.

- Configure the other fields in the Prices record as necessary.

- Configure Filter Rules as needed to define the circumstances under which this price applies. For example, this price may apply to customers who are in only a certain Tax Jurisdiction. If a customer is not subject to sales tax but receives this price due to other matching criteria, then that customer will be charged the entire price (and no implicit tax is included in the calculation).

- See Assigning Product Prices for more information on specifying a product's price.

- Click OK to save and close the Prices record.

Save and close the Products record.

Note Concerning Price Includes Tax Calculation

When using the Price Includes Tax option in conjunction with an order line that has both a child sales tax rate and a parent sales tax rate applied (that is, the child rate has the Override Parent Tax Rates option cleared), Aptify calculates the tax amount under the assumption that the child tax includes the parent tax amount in its calculation.

This holds true even if a child Sales Tax Rate has the Include Parent Taxes In Calculation option cleared.

Copyright © 2014-2019 Aptify - Confidential and Proprietary