Marking a Product As Taxable

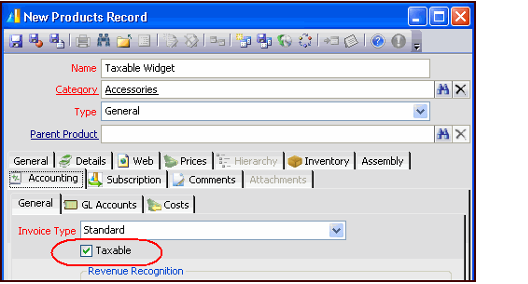

Follow these steps to indicate that a new product is taxable:

- Open a new record from the Products service.

- Complete the top area of the Products form.

- Specify a name, Product Category, Product Type, and parent product (if applicable).

- Specify a name, Product Category, Product Type, and parent product (if applicable).

- Click the Accounting tab.

- Select the Taxable option.

- Complete the other fields on the Products record, as required.

- See Creating a Basic Products Record for more information on setting up new products in Aptify.

- See Creating a Basic Products Record for more information on setting up new products in Aptify.

- Save the new Products record.

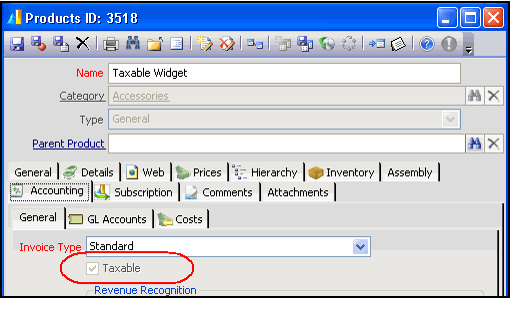

After you save the product record, the Taxable field becomes read-only and cannot be modified.

A user can only identify a product as taxable prior to the first save. After a new Products record is saved, a user can no longer modify the Taxable field. Therefore, you should confirm that a product has the Taxable field configured properly before saving the record.

By default, Aptify applies the sales tax for any product that has the Taxable option selected, assuming that the order's Ship To/Bill To parties match a configured Sales Tax Rate.

However, an organization can conditionally tax certain products by establishing Order Line Filter Rules in one or more Sales Tax Rate. Using filter rules, a product may be taxed under one set of conditions but not another. See Specifying Order Lines Filter Rules for details.

Related content

Copyright © 2014-2019 Aptify - Confidential and Proprietary