Using the Mark-To-Market Wizard

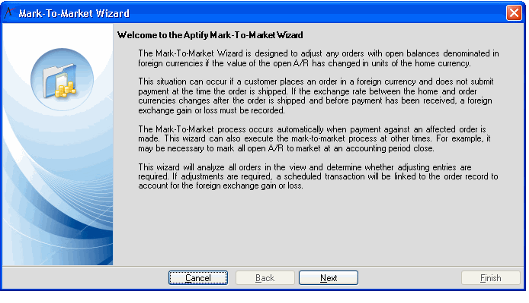

The Aptify Mark-To-Market wizard is designed to adjust orders with open balances denominated in foreign currencies if the organization's functional currency value of the open Accounts Receivable (A/R) has changed.

The Mark-To-Market object executes automatically, and in the background, under any of the following conditions:

- When an order is taken in a foreign currency and the order is marked as shipped.

- When payment against a shipped foreign currency order is made.

- When the costs of goods sold (COGS) are calculated for products on a foreign currency order.

The tasks that are executed when the Mark-To-Market object runs include:

- Accessing the appropriate Currency Spot Rates record and creating a derived spot rate, if necessary.

- Creating an Order Currency Spot Rates record.

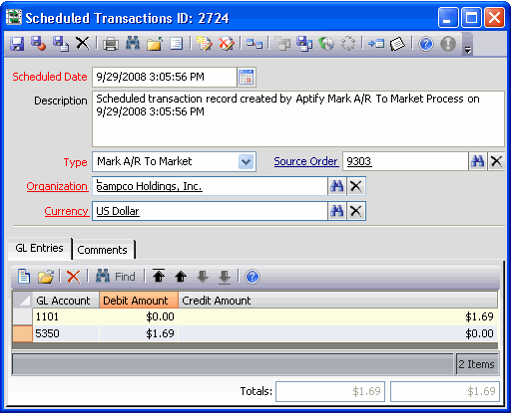

- When the Mark-To-Market object is executed because a payment is received, it also creates the Scheduled Transactions record that contains the general ledger (GL) entries for the gain or loss on the transaction.

- Creating the COGS GL entries.

The Mark-To-Market wizard can be run at any time, but is commonly executed when an accounting period closes and accounts receivable or payable balances related to foreign currency transactions exist.

The tasks executed by the Mark-To-Market wizard include:

- Analyzing each order in the view to determine whether adjusting entries are required. Adjusting entries are required for shipped Orders with an open balance if there is a Currency Spot Rates record that is more current than the Currency Spot Rates record referenced by the most current Order Currency Spot Rates record. A derived Currency Spot Rates record is created if necessary.

- If adjustments are required, an Order Currency Spot Rates record is created.

- Scheduled Transactions records are created to reflect the GL entries for the transaction gains or losses.

Follow these steps to run the Mark-To-Market wizard:

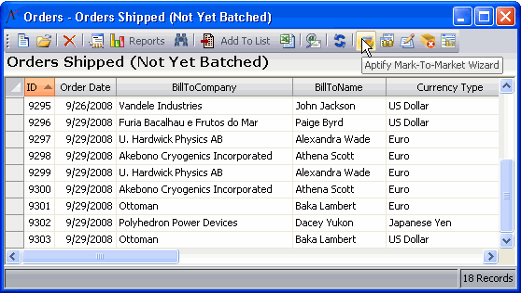

- Create or open a view of orders that contains the records you want the wizard to evaluate.

- Click the Aptify Mark-To-Market icon in the view toolbar to launch the wizard.

- Review the information on the Welcome screen and click Next to continue.

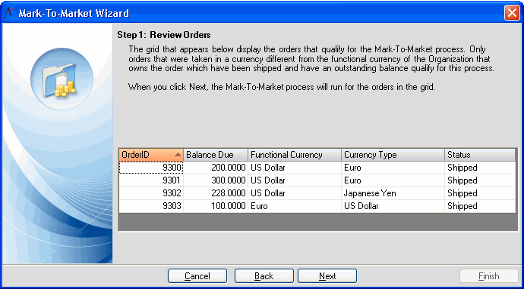

- Review the set of orders that qualify for the Mark-To-Market process. The criteria that qualifies an order for the Mark-To-Market process are:

- Currency Type is not the organization's functional currency

- Marked as shipped

- Outstanding balance exists

- Click Next to process the orders listed.

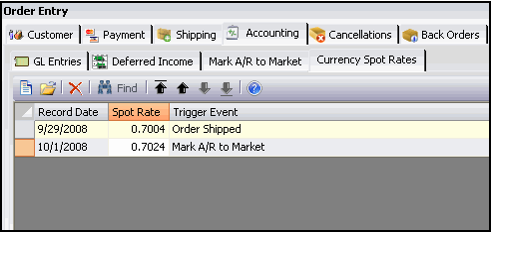

- During processing, each order's most current Order Currency Spot Rates record is compared to the most current Currency Spot Rates record. If the rates are different, a new Order Currency Spot Rates record is created and a Scheduled Transactions record is created to reflect the gain or loss.

- During processing, each order's most current Order Currency Spot Rates record is compared to the most current Currency Spot Rates record. If the rates are different, a new Order Currency Spot Rates record is created and a Scheduled Transactions record is created to reflect the gain or loss.

- After processing, the wizard displays a Process Confirmation window. Click Finish to close the Mark-To-Market wizard.

- This figure illustrates an order for which the Mark-To-Market wizard created a new Currency Spot Rates record. The original rate (0.7004) was recorded at the time the order shipped. The new rate (0.7024) was added by the wizard.

- This figure illustrates a Scheduled Transactions record created by the wizard to record a foreign currency loss due to the change in currency spot rates since the order originally shipped.

Related content

Copyright © 2014-2017 Aptify - Confidential and Proprietary