Specifying Tax Exempt Status

Certain customers, such as a non-profit organization, may be not have to pay sales tax in one or more jurisdictions. An organization can track the tax exempt status for customers in their corresponding Persons (for individual orders) or Companies record.

If a Bill To party on an order is tax-exempt for a jurisdiction's sales tax rate, the system does not add sales tax to the order line(s) to which the tax rate would normally apply.

Follow these steps to specify that a person or company is exempt from paying a particular sales tax rate:

- Open a Persons or Companies record.

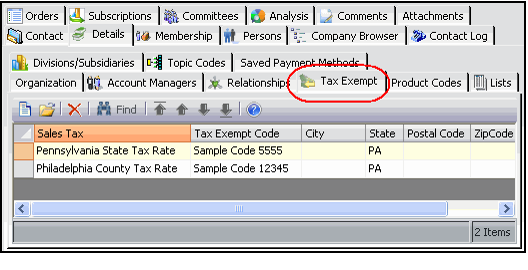

- Click the Details > Tax Exempt tab.

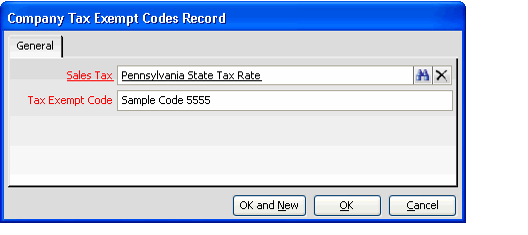

- Open a new Tax Exempt Codes record.

- In the Sales Tax field, enter a sales tax record from which this person or company is exempt.

- This field links to the Sales Tax Rate service.

- Enter the person's or company's Tax Exempt Code in the field provided.

- A tax jurisdiction assigns tax-exempt entities this code. A user should obtain this code from the person or company.

- This field is required to save to save the Tax Exempt Codes record.

- Click OK to saved and close the record.

- Create additional Tax Exempt Codes records, as necessary.

- Alternatively, you can click OK and New in Step 6 to save the current record and open a new Tax Exempt Codes record in one step.

- Alternatively, you can click OK and New in Step 6 to save the current record and open a new Tax Exempt Codes record in one step.

Save and close the Persons or Companies record.

See Using the Persons Service and Using the Companies Service for more information on working with Persons and Companies records.

Related content

Copyright © 2014-2019 Aptify - Confidential and Proprietary