Managing Tax Exemptions for a Person

When tax is calculated for an order, the Bill To person (if a Bill To company is not specified) pays the tax based on the Ship To destination of the order. However, under some circumstances, a person may be exempt from paying taxes in certain jurisdictions. If a person has tax exempt status in the Ship To destination, then the person will not charged sales tax on the order. See Specifying Tax Exempt Status for more information.

Whether an order is taxed depends on if the Bill To person is tax-exempt in the Ship To location. For example, John Smith is tax-exempt in New York but not in Ohio. When John Smith is the Bill To party and the order ships to Ohio, the order is taxed. When John Smith is the Bill To party and the order ships to New York, no tax is charged on the order.

You specify the sales tax rates from which a person is exempt on a person's Tax Exempt Codes tab. Follow these steps:

- Open the Persons record.

- Click the Details tab.

- Click the Person Tax Exempt Codes sub-tab.

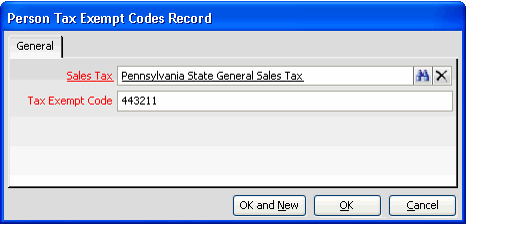

- Click the New icon to open a new Person Tax Exempt Code record.

- Specify the sales tax rate from which the person is exempt in the Sales Tax field.

- This field links to the Sales Tax service. See Managing the Sales Tax Infrastructure for details.

- This field links to the Sales Tax service. See Managing the Sales Tax Infrastructure for details.

- Enter the person's tax exempt code, which it obtained from the appropriate taxing authority, in the Tax Exempt Code field. This field is required to save the record.

- Click OK.

- Save the Persons record.

- If you recently entered an order for this person before modifying the tax exempt status, close and reopen the Aptify Desktop client. This will refresh the Order Entry system's data and ensure that the new tax exemption information is used the next time you place an order for this customer.

Related content

Copyright © 2014-2019 Aptify - Confidential and Proprietary